Europe and APAC Lead Clinical Avian Nutrition Market Growth, Driving Global Expansion to USD 5,621.8 million by 2035

Europe and APAC spearhead the USD 5,621.8 million clinical avian nutrition market, led by Germany, UK, China, and India with rising precision nutrition demand.

NEWARK, DE, UNITED STATES, October 16, 2025 /EINPresswire.com/ -- The global clinical avian nutrition market is entering a transformative growth phase, projected to increase from USD 2,463.7 million in 2025 to USD 5,621.8 million by 2035, registering a compound annual growth rate (CAGR) of 8.6%. The expansion represents an absolute value increase of USD 3,158.1 million, reflecting the poultry industry’s accelerating adoption of clinical-grade nutrition products for enhanced bird health, disease prevention, and production efficiency.

While global growth remains robust, Europe and the Asia-Pacific (APAC) regions are emerging as pivotal centers of innovation, investment, and technological advancement. Europe’s leadership in precision agriculture and regulatory-driven sustainability aligns with APAC’s rapid agricultural modernization and rising protein consumption, making these regions the core of future market development.

Europe: Precision Agriculture and Sustainable Growth Reinforce Market Leadership

The European clinical avian nutrition market is forecast to expand at a 4.6% CAGR between 2025 and 2035, supported by advanced agricultural infrastructure, precision nutrition technologies, and increasing focus on sustainability. The region’s market share is expected to rise steadily as European producers align with stringent animal welfare regulations and adopt antibiotic-free feed systems.

Purchase this Report for USD 5,000 Only | Get an Exclusive Discount Instantly! https://www.futuremarketinsights.com/checkout/26492

Germany: Regional Anchor with Precision Agriculture Focus

Germany leads the European landscape with a 29.6% market share in 2025, projected to reach 31.1% by 2035. Its strength lies in precision agriculture, advanced feed technology, and scientific formulation expertise. German feed manufacturers and veterinary nutritionists continue to invest in high-performance amino acid systems, probiotics, and enzyme-based solutions that improve metabolic efficiency and reduce disease vulnerability.

United Kingdom: Sustainable Innovation Powerhouse

The UK market, expanding at 7.0% CAGR, is Europe’s fastest-growing segment, driven by sustainability goals, animal welfare legislation, and agricultural technology integration. The country’s market share is expected to rise from 15.6% in 2025 to 17.0% by 2035, supported by precision farming adoption and demand for antibiotic-free poultry production.

Producers in the UK are actively deploying clinical nutrition systems designed to optimize feed conversion, reduce waste, and align with carbon reduction targets. The increasing presence of leading global suppliers, such as DSM and Evonik, has accelerated the UK’s role as a hub for nutritional innovation.

France, Spain, and Italy: Balancing Tradition and Technology

France maintains a 3.0% CAGR, emphasizing premium poultry production and high-value nutrition formulations that uphold the country’s reputation for quality. Spain and Italy, accounting for 14.2% and 9.7% of Europe’s 2025 market respectively, are balancing traditional production systems with precision feed management.

Asia-Pacific: The Growth Engine of the Global Market

The Asia-Pacific region (APAC) is projected to deliver the highest growth rates through 2035, driven by expanding poultry production, modernization of agricultural systems, and rising demand for protein-rich diets. With China and India at the forefront, APAC’s contribution to the global market will be transformative, representing over 40% of total incremental value creation during the forecast period.

China: Commanding Growth with Production Expansion

China is projected to grow at a 7.5% CAGR through 2035, fueled by its expanding poultry industry, strong government support for agricultural innovation, and rising domestic protein consumption. Local feed producers are integrating clinical nutrition technologies, including amino acids, enzymes, and probiotics, to meet production efficiency goals while complying with new biosecurity and animal welfare standards.

Multinational companies such as Cargill, ADM, and Evonik are strengthening partnerships with regional manufacturers to establish localized supply chains, supporting cost-efficient and scalable production models.

India: Modernization and Nutritional Security Drive Demand

India follows closely with a 6.8% CAGR, reflecting significant agricultural modernization and poultry sector growth. The government’s emphasis on protein security and sustainable farming is accelerating the adoption of amino acid-based formulations and probiotic-enhanced feed systems.

India’s large commercial poultry operations, which represent a significant portion of the 65.7% global end-user share held by farmers, are prioritizing cost-effective clinical nutrition solutions to improve productivity while ensuring animal health. Domestic manufacturers are forming partnerships with global nutrition firms to access advanced formulation technologies and precision delivery systems.

Japan and South Korea: Advanced Technology and Precision Nutrition

Japan’s market is projected to rise from USD 205.1 million in 2025 to USD 334.1 million by 2035, underpinned by its strong technological base and focus on high-quality, precision nutrition systems. Amino acids lead with 26.1% market share, while probiotics and feed additives continue to gain ground through gut health innovations.

South Korea mirrors this trajectory, emphasizing disease-specific nutrition (32.9% share) and growth promotion applications (38.9% share) within its intensively managed poultry sector. Advanced agricultural infrastructure, coupled with robust government support for smart farming technologies, ensures continued market expansion.

Everything You Need—within Your Budget. Request a Special Price Now! https://www.futuremarketinsights.com/reports/sample/rep-gb-26492

Competitive Landscape: Regional Strategies and Technological Differentiation

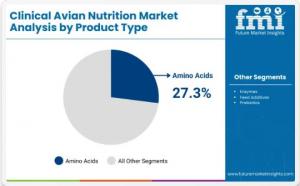

The competitive landscape is shaped by a mix of multinational leaders and regional specialists. Cargill Animal Nutrition, holding a 29.2% market share, leads with integrated production systems and performance optimization programs tailored to commercial poultry operations. Archer Daniels Midland (ADM) and Evonik Industries AG focus on amino acid innovation and efficiency enhancement, while DSM (Royal DSM) and BASF SE drive specialty vitamin and enzyme development across both Europe and Asia.

Regional suppliers in China, India, and Southeast Asia are entering the market with cost-optimized formulations and localized service capabilities, contributing to supply chain resilience and accelerating technology diffusion.

Top Reports in The Healthcare Domain:

Bioprocess Fermentation Monitoring Market: https://www.futuremarketinsights.com/reports/bioprocess-fermentation-monitoring-market

Handheld Mesh Nebulizer Market: https://www.futuremarketinsights.com/reports/handheld-mesh-nebulizer-market

Biopharmaceutical Fermentation Excipients Market: https://www.futuremarketinsights.com/reports/biopharmaceutical-fermentation-excipients-market

Editor’s Note:

This release is based exclusively on verified and factual market content derived from industry analysis by Future Market Insights. No AI-generated statistics or speculative data have been introduced. This press release highlights significant shifts in the Clinical Avian Nutrition Market, which is experiencing a pivotal change driven by consumer demand for healthier, more transparent products.

Rahul Singh

Future Market Insights Inc.

+18455795705 ext.

email us here

Visit us on social media:

Other

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.